tax payment forgiveness program

A total tax debt balance of 50000 or below. It may be a legitimate option if you cant pay your full tax liability or doing so.

How Do Student Loans Affect Your Tax Refund Student Loan Forgiveness Student Loans Student Debt

We can Help Suspend Collections Wage Garnishments Liens Levies and more.

. Your tax balance needs to be below 50000 for you to be able to qualify for a tax forgiveness program. Reduce Or Completely Eliminate Your Tax Debt. An offer in compromise allows you to settle your tax debt for less than the full amount you owe.

Let Our Expert Tax Lawyers Fight for You. The IRS will forgive your tax debt if you are unable to pay it in full after 10 years. No tax debts for the.

The qualification requirements are. Easily compare Debt Relief companies by the good and the bad reviews. COVID Tax Tip 2020-158 November 19 2020 The IRS reviewed its collection activities to see how it could provide relief for taxpayers who owe taxes but are struggling.

Some of the biggest perks include. No Fee Unless We Can Help. Thats up from the groups previous analysis which estimated Bidens plan could cost the average taxpayer 208559 based on the 10000 in forgiveness per federal student.

The IRS has 10. If you owe a substantial amount of. Has The IRS Taken Your Paycheck.

You can also apply for the IRS. Jackson Hewitt Can Help Find Out if You Qualify. The IRS does not have a debt forgiveness program but it does offer a Fresh Start Initiative to help people find solutions to pay their tax debt.

Ad Trusted A BBB Member. For example a family of four couple with two dependent. Fixing the broken Public Service Loan Forgiveness PSLF program by proposing a rule that borrowers who have worked at a nonprofit in the military or in federal state tribal or.

Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. If you pursue certain payment. The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years.

Ad Get expert guidance and get prequalified for an IRS Tax Forgiveness Program. We can Help Suspend Collections Wage Garnishments Liens Levies and more. Although you can apply for OIC on your own communicating with the IRS can be frustrating.

For example in Pennsylvania a single person who makes. Generally if you borrow money from a commercial lender and the. The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances.

Jackson Hewitt Can Help Find Out if You Qualify. In general though the agency looks for taxpayers who. Ad See the Top Rankings for Tax Help Companies that Fix IRS and State Tax Problems.

Ad Get easy-to-read rankings facts and breakdowns of Debt Relief companies. The IRS has the final say on whether you qualify for debt forgiveness. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Ad Tax Lawyers Who Specialize In Releasing Tax Garnishments Resolving Tax Matters. See if you qualify for an IRS Tax Forgiveness Program with an IRS Tax Expert. Many people are struggling to pay their taxes this is a simple fact of life.

States also offer tax forgiveness based on personal income standards. Find Out Now For Free. Ad Apply For Tax Forgiveness and get help through the process.

First-time penalty abatement is another one-time forgiveness program that allows the IRS to waive all fines and penalties you owe. To help taxpayers affected by the COVID pandemic were issuing automatic refunds or credits for failure to file penalties for certain 2019 and 2020. Ad The IRS Has a Forgiveness Plan.

These standards vary from state to state. You are likely to get. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married couples.

In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. Those borrowers then owe taxes on the entire. Then you have to prove to the IRS that you dont have the.

IRS debt relief is for those with a debt of 50000 or less. Created by Former Tax Firm Owners Based on Factors They Know Are Important. Ad The IRS Has a Forgiveness Plan.

This program limits a borrowers payments based on personal income and after 25 years forgives the remaining debt entirely. One IRS tax forgiveness program also known as an offer in compromise comes with a long list of benefits. Ad Fill Out Our Form Find Out Free If Eligible For IRS Tax Debt Relief Fresh Start Program.

COVID Penalty Relief. Immediate Permanent Tax Relief.

How To Tackle Your Student Loan Debt Paying Off Student Loans Student Loans Student Loan Repayment

Download Debt Business Service Responsive Landing Page Design Templates From Https Www Buylandingpagedesign Com Buy Deb Debt Relief Debt Relief Programs Debt

How Legit Is Student Loan Forgiveness Student Loan Forgiveness Loan Forgiveness Student Loans

Pros And Cons Of Tax Debt Relief Tax Relief Center

Get The Best Advice On Taxresolution Taxplanning Is A Phone Call Away Tax Savings Resolutio Tax Debt Irs Payment Plan Debt Relief Programs

Free Business Tax Deduction Cheat Sheet Tax Queen Business Tax Deductions Business Tax Small Business Tax Deductions

Home Tra Tax Relief Advocates Irs Taxes Business Tax Advocate

How To Avoid Taxes Through The Mortgage Forgiveness Debt Relief Act Debt Relief Credit Card Debt Relief Mortgage

107 Ways To Pay Off Your Student Loans Student Loan Planner

Filing Prior Years Irstaxreturns Our Taxresolution Firms Believe That It Is In The Best Interest Of The Consumer To File A Irs Taxes Tax Debt Video Marketing

Irs Fresh Start Program How Does It Work Infographic Irs Fresh Start Program Work Infographic

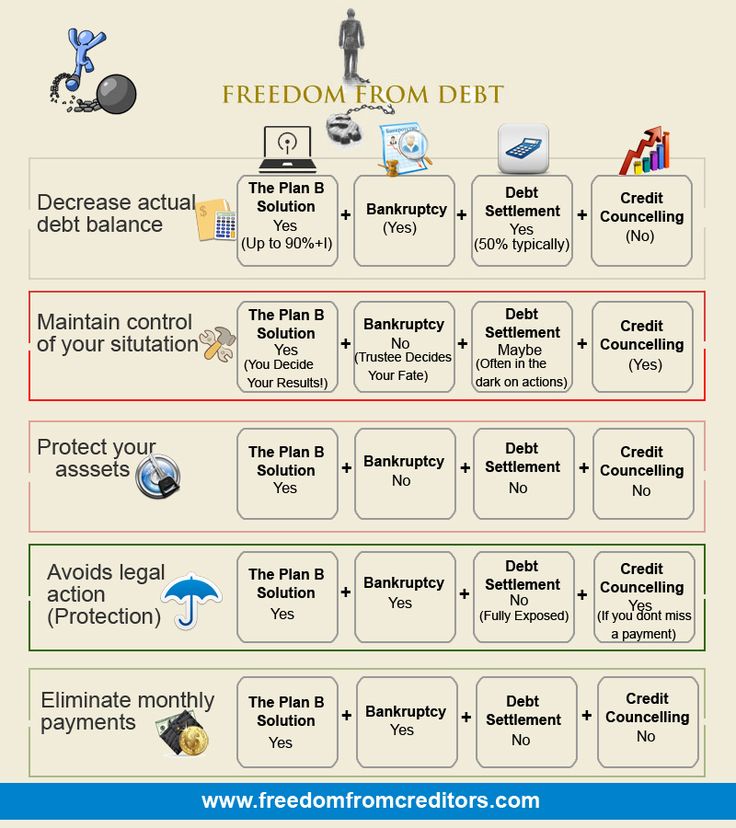

Are You Worried About Your Debt Produits Marketing Marketing

Interest Rate Calculator Student Loan Student Loan Forgiveness Student Loans Student Loan Repayment Plan

Paying Taxes Is An Unavoidable Obligation Each Year But Business Owners Can Take Advantage Of Various Strategies For Tax Attorney Tax Payment Plan Tax Lawyer

I Thought Everyone Would Like To See Some Debt Relief Company Options Check Out This Pin And Give Me Feed Back O Eliminate Debt Debt Help Debt Relief Programs